Discussions on the effectiveness of “long-term investment” have been ongoing for a long time.

In particular, in the case of stocks, some say that it is beneficial to realize profits if they enter a certain level of profitability in the short term, while others say that long-term investments should be made at a long tempo of more than 10 years without dwelling on such a calm wave.

I think those who have been deeply concerned about investment will continue their investment life on one axis with their own principles, and I will write down my personal opinion after thinking about it.

1. Monetary vs Asset

Before talking about long-term investment, it is necessary to compare the flow of “money (cash)” value with the flow of “asset (investment target)” value.

This is because the concept of “investment” is a series of processes in which I exchange the money I have for assets, sell my assets purchased, and convert them into currency.

We find jobs and work in our late 20s and early 30s, generate a certain level of income every month, and set the amount that can be invested in consideration of the consumption power required for life.

If you start your investment life early, you can generally start in your 20s, and if you start a little later, you can start in your late 30s to early 40s.

By living such an investment life, we will invest in our early 60s at the earliest, when we retire, or until we die. In the end, our investment life is as short as 20 years and as long as 60 to 80 years. This means that you will invest for at least 20 years.

2. What values are uplifting in the long term

Whether it is an investment pattern that frequently exchanges money and assets through mid-term trading or an investment pattern that accumulates assets in the long term, most people who invest will continue their investment life for more than 20 years.

If so, we need to compare the value flow of money with the value flow of assets when we continue to invest at a long tempo of more than 20 years.

Which of the money or assets will increase in value in the long term, and which should be continuously accumulated due to its high exchange value.

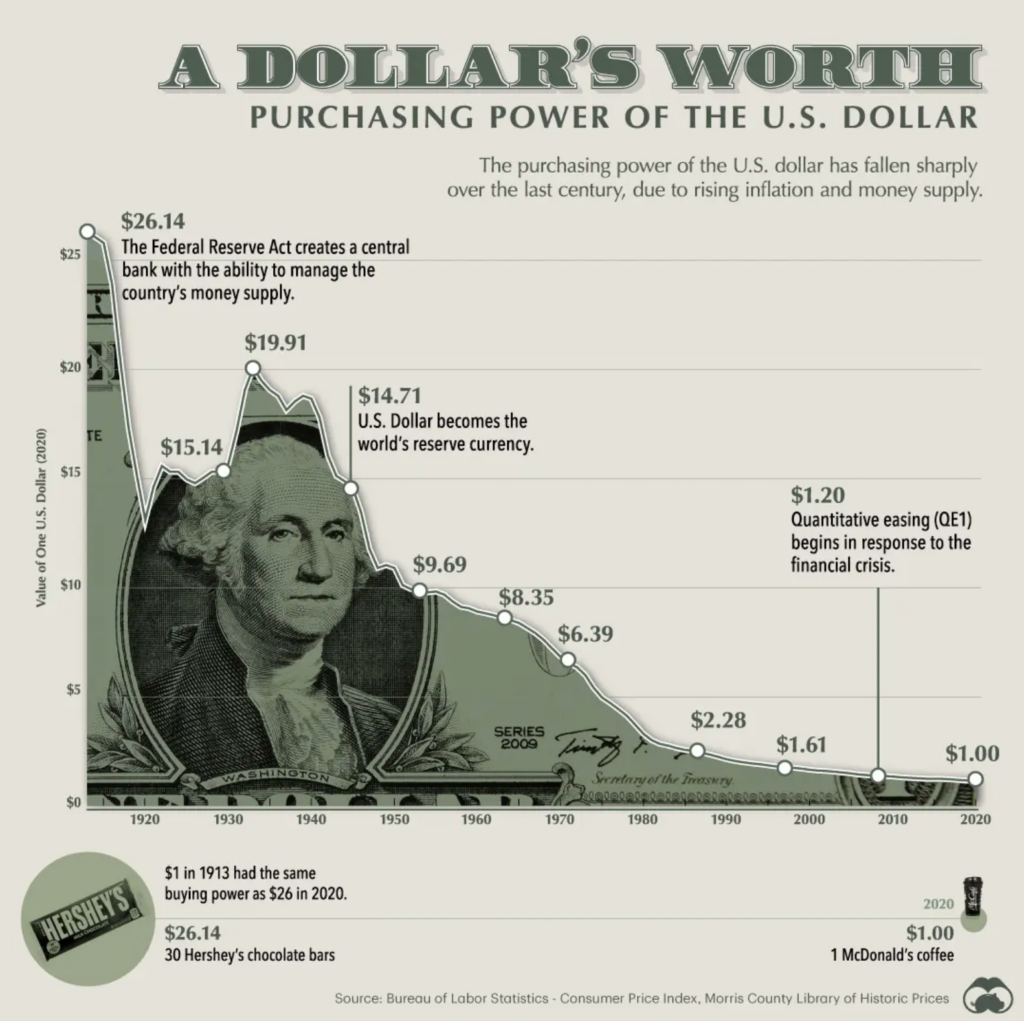

3. Value of money: purchasing power

First, the greatest value of money is the ‘purchasing power’ to exchange something.

It is the power to purchase everything we need in our daily lives, such as buying food, purchasing furniture, going to a beauty salon, buying school supplies, and paying for transportation.

Some of the things that can be purchased through money are those that end up as one-time consumption (almost everything such as food, daily necessities, etc.), and those that can be held semi-permanently (assets of real estate, stocks, etc.).

This change in the purchasing power of money can be said to be a change in the value of money, and the value of this money continues to decline over a long period of time. Look at inflation, which is a hot issue these days.

In other words, inflation is a decrease in the amount of goods that can be purchased in the same currency.

In the past, if you could buy two bags of snacks with 1,000 won, you would be able to buy only one bag due to inflation, and you would not be able to buy one bag.

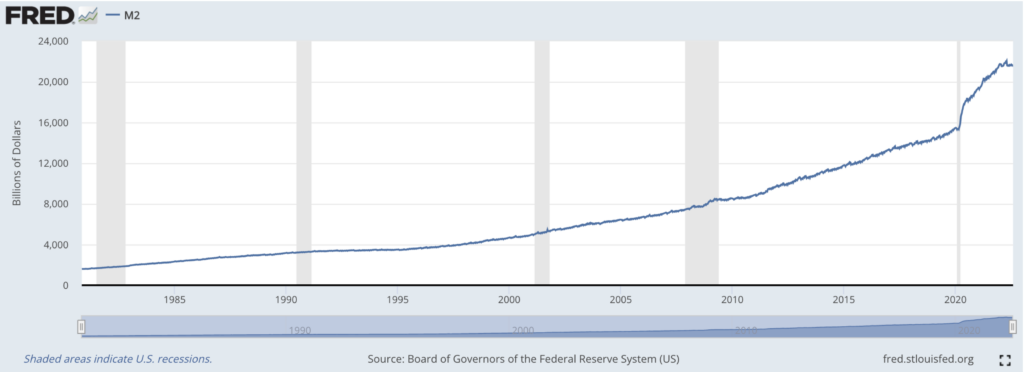

4. Trend and Forecast of Money Volume Growth

The United States, the world’s key currency, has been continuously expanding the issuance of money (dollar) for a long period of time, and the increase in the amount of money will naturally lead to an increase in prices, and this trend will continue.

Due to the ever-increasing amount of money, the value of money has to continue to decline in the long term, and it can be seen that “cash is trash” is not wrong at all.

5. Decline in the value of money & Rise in the value of assets

Among the things we can buy in cash, the value of semi-permanent possessions (real estate, stocks, etc.) continues to rise over a long period of time due to the decline in the value of money, rising prices, and rising corporate value. In the end, we can conclude that it is wise to invest in assets that are constantly rising in cash other than the essential amount that we have.

6. Conclusion : long-term investment

Money has the property of value that continues to decline in the long term, and assets have the property of value that continues to rise in the long term.

If we return to what the right investment principles are based on this premise, it can be said that continuing to exchange our cash for assets is the right investment direction.

Just because the value of the assets I bought has risen a little, I think it’s a way to enjoy a long-term comfortable and safe investment life if I exchange it for cash again for a continuously declining value, and if I stay on a train that runs well rather than exchanging cash and assets frequently.

https://www.cnbc.com/world/?region=world